Does your local or state realtors association put out stats every month? Would you like to use those stats to produce content that sets you up as a market expert in the eyes of buyers and sellers and other real estate professionals?

In this post, I will show you how to use AI to accomplish this.

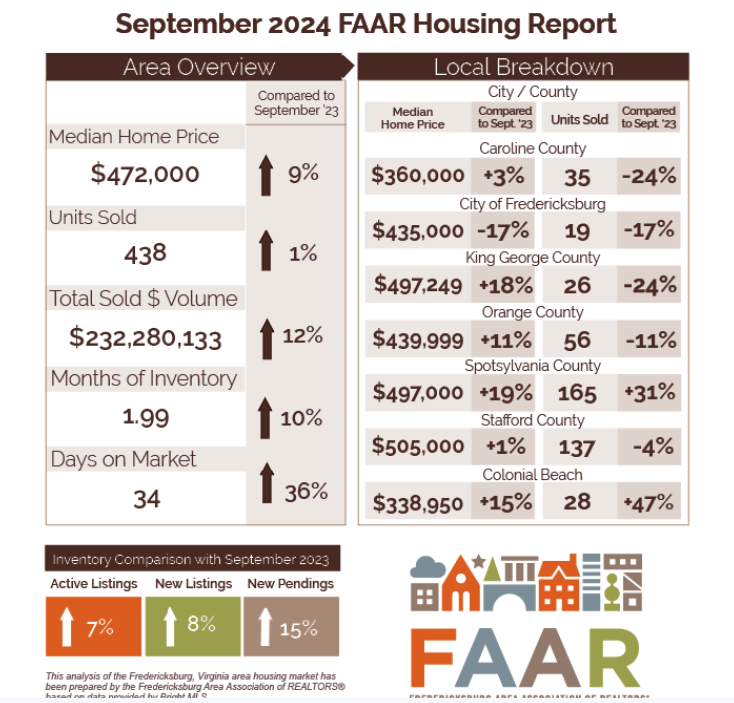

Step 1– I took the graphic produced by my association and snipped it from Facebook where they had published it. On a windows computer hit and hold windows-shift-s or on a Mac hit control-shift-4. Here is the graphic.

Step 2– I then pasted the graphic in ChatGPT 4.0 Canvas and gave the the GPT the following prompt:

Prompt: You are a real estate analyst expert. Please provide a summary of these numbers to be shared with the public.

The first summative iteration was a little short for my liking and so I further prompted the GPT to expand on the summary which it did very nicely. (See the text it generated at the end of this post).

Step 3– Create a social media post with your summary. You can past the whole summary. Or, better yet, prompt the GPT further to create a series of Facebook posts based on the summary providing interesting snippets based on the data.

Here is the text summary the GPT provided.

September 2024 Housing Market Report: A Closer Look at Fredericksburg Area Trends

The housing market in the Fredericksburg region continues to evolve, showing both opportunities and challenges for buyers and sellers. The September 2024 FAAR Housing Report provides a comprehensive snapshot of the area’s real estate activity compared to September 2023, highlighting shifts in pricing, inventory, and buyer demand.

Area Overview:

The median home price in the Fredericksburg area rose to $472,000, reflecting a 9% increase from September 2023. This increase points to steady demand and a competitive market environment. A total of 438 units were sold during September, representing a modest 1% rise from the previous year, indicating relatively stable transaction activity in the region.

In terms of the overall dollar value, the total sales volume reached $232,280,133, which is a 12% increase compared to September 2023. This increase in total dollar volume, despite only a slight rise in units sold, suggests that higher home prices are driving up the overall market value.

Inventory remains a key concern for the area, with months of inventory at just 1.99, a 10% decrease from last year. This tight inventory environment is contributing to rising prices as buyers face fewer options. Homes are taking longer to sell, with the average days on market climbing to 34 days, representing a 36% increase. This suggests that although prices are higher, buyers may be exercising caution or taking longer to make decisions due to affordability concerns.

Local Breakdown:

Breaking down the market by locality provides a more nuanced picture:

- Caroline County experienced a 3% increase in the median home price to $360,000, while the number of units sold dropped by 24%, suggesting reduced buyer activity perhaps due to affordability or other local market dynamics.

- City of Fredericksburg saw a significant decline in both price and sales volume. The median home price dropped by 17% to $435,000, and units sold decreased by 17%. This could indicate a shift towards more affordable housing or a cooling off of demand in the city.

- King George County reported an 18% rise in the median home price, reaching $497,249, even though units sold fell by 24%. This reflects strong price resilience despite fewer transactions, indicating that the homes that did sell commanded higher prices.

- Orange County showed positive growth, with the median home price increasing by 11% to $439,999, though units sold decreased by 11%, hinting at a slightly softer demand.

- Spotsylvania County was a standout, with a 19% rise in median home price to $497,000 and a significant 31% increase in units sold, totaling 165 units. This suggests a strong demand for housing in Spotsylvania, making it one of the more active markets in the area.

- Stafford County experienced a 1% increase in the median home price to $505,000, with units sold slightly decreasing by 4%. The stability in pricing indicates consistent demand.

- Colonial Beach saw the largest percentage increase in sales activity, with units sold rising by 47% to 28 units, while the median price also rose 15% to $338,950. This points to growing interest in Colonial Beach, potentially due to affordability compared to other areas in the region.

Market Dynamics:

The inventory situation continues to be a challenge across the board, as active listings increased by only 7% compared to last year, while new listings rose by 8%. However, new pending sales saw a significant 15% increase, highlighting that buyer interest remains robust, even as inventory remains tight. The rise in pending sales suggests that many buyers are keen to lock in purchases despite rising prices and longer days on the market.

Overall, the Fredericksburg area housing market is characterized by increasing home values, low inventory, and stable but varied demand across different localities. Buyers face challenges due to limited options and higher prices, while sellers benefit from increased property values. Spotsylvania County and Colonial Beach stand out as areas with notable sales growth, indicating strong buyer interest. Meanwhile, areas like Fredericksburg City and King George County face declining sales but show resilience in home values, reflecting changing market preferences and conditions.

For potential buyers, this environment requires careful navigation, particularly in evaluating affordability and competition. Sellers, on the other hand, are benefiting from appreciating home values but may need to adjust expectations regarding the time required to close a sale. The market’s overall trajectory suggests a need for adaptability on both sides as inventory remains a critical factor influencing activity and pricing.